Tim Sykes, a renowned penny stock trader, has been a dominant force in the trading world for over two decades. With a net worth estimated to be over $10 million, Sykes has built a reputation as a successful trader and educator. He has been featured in various media outlets, including CNN, Forbes, and Bloomberg, and has written several best-selling books on trading.

Sykes' success can be attributed to his unique approach to trading, which emphasizes discipline, patience, and a deep understanding of market dynamics. He has developed a set of trading strategies and techniques that have helped him and his students achieve remarkable results. In this article, we will reveal 7 Tim Sykes trading tips that can help you improve your trading skills and achieve success in the markets.

Tip 1: Focus on Penny Stocks

Sykes is known for his expertise in penny stock trading, and for good reason. Penny stocks offer a unique opportunity for traders to profit from the volatility and unpredictability of these low-priced stocks. By focusing on penny stocks, Sykes is able to capitalize on the rapid price movements that occur in these stocks, often resulting in significant profits.

Why Penny Stocks?

Penny stocks are attractive to Sykes and other traders because they offer several advantages, including:

High volatility: Penny stocks are known for their rapid price movements, making them ideal for traders who want to profit from short-term price fluctuations. Low barriers to entry: Penny stocks are often priced low, making them accessible to traders with limited capital. High potential for profit: Penny stocks can experience significant price increases, resulting in substantial profits for traders who make the right trades.

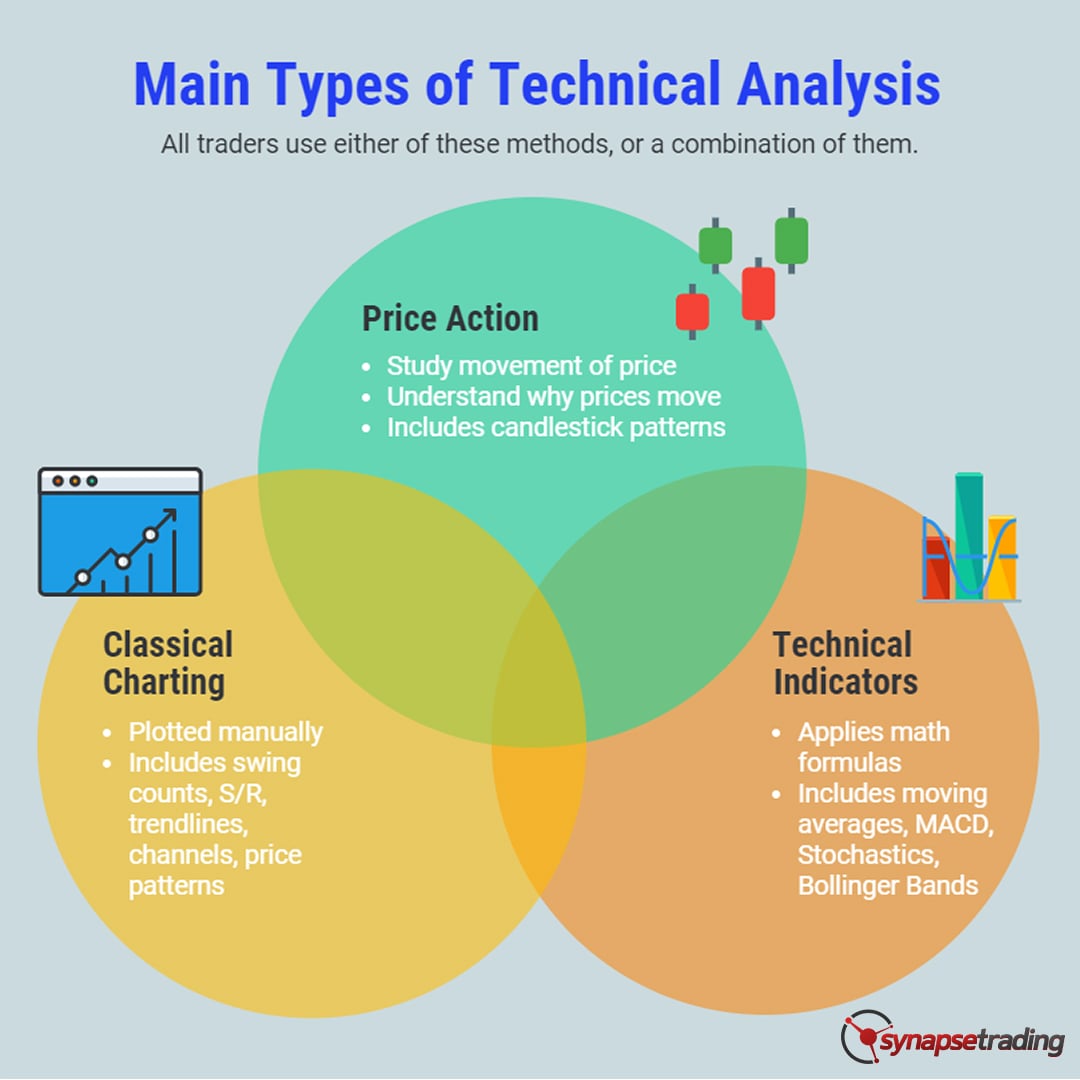

Tip 2: Use Technical Analysis

Sykes is a strong proponent of technical analysis, which involves studying charts and patterns to identify trading opportunities. By analyzing charts and identifying trends and patterns, Sykes is able to make informed trading decisions and increase his chances of success.

Key Technical Indicators

Sykes uses a variety of technical indicators to analyze charts and identify trading opportunities. Some of the key indicators he uses include:

Moving averages: Sykes uses moving averages to identify trends and determine the direction of the market. Relative strength index (RSI): Sykes uses RSI to measure the strength of a stock's price movement and identify potential trading opportunities. Bollinger Bands: Sykes uses Bollinger Bands to measure volatility and identify potential breakouts.

Tip 3: Trade with a Plan

Sykes emphasizes the importance of having a trading plan, which outlines a trader's goals, risk tolerance, and entry and exit strategies. By trading with a plan, Sykes is able to stay disciplined and focused, even in the face of market volatility.

Key Components of a Trading Plan

A trading plan should include the following components:

Goals: A trader's goals should be specific, measurable, and achievable. Risk tolerance: A trader should have a clear understanding of their risk tolerance and be willing to adjust their strategy accordingly. Entry and exit strategies: A trader should have a clear plan for entering and exiting trades, including the use of stop-loss orders and profit targets.

Tip 4: Manage Risk

Sykes emphasizes the importance of risk management, which involves identifying and mitigating potential risks. By managing risk, Sykes is able to protect his capital and increase his chances of success.

Key Risk Management Strategies

Some key risk management strategies that Sykes uses include:

Position sizing: Sykes uses position sizing to limit his exposure to potential losses. Stop-loss orders: Sykes uses stop-loss orders to limit his losses in the event of a trade going against him. Diversification: Sykes diversifies his portfolio to reduce his exposure to potential losses.

Tip 5: Stay Disciplined

Sykes emphasizes the importance of staying disciplined, which involves sticking to a trading plan and avoiding impulsive decisions. By staying disciplined, Sykes is able to avoid making costly mistakes and increase his chances of success.

Key Disciplines

Some key disciplines that Sykes uses include:

Sticking to a trading plan: Sykes sticks to his trading plan, even in the face of market volatility. Avoiding impulsive decisions: Sykes avoids making impulsive decisions, which can lead to costly mistakes. Staying focused: Sykes stays focused on his goals and avoids distractions.

Tip 6: Continuously Learn

Sykes emphasizes the importance of continuously learning, which involves staying up-to-date with market trends and developments. By continuously learning, Sykes is able to stay ahead of the curve and increase his chances of success.

Key Learning Strategies

Some key learning strategies that Sykes uses include:

Reading books and articles: Sykes reads books and articles to stay up-to-date with market trends and developments. Attending seminars and webinars: Sykes attends seminars and webinars to learn from other traders and experts. Joining online communities: Sykes joins online communities to connect with other traders and learn from their experiences.

Tip 7: Stay Patient

Sykes emphasizes the importance of staying patient, which involves waiting for the right trading opportunities and avoiding impulsive decisions. By staying patient, Sykes is able to avoid making costly mistakes and increase his chances of success.

Key Patience Strategies

Some key patience strategies that Sykes uses include:

Waiting for the right trading opportunities: Sykes waits for the right trading opportunities, rather than trying to force trades. Avoiding impulsive decisions: Sykes avoids making impulsive decisions, which can lead to costly mistakes. Staying focused: Sykes stays focused on his goals and avoids distractions.

In conclusion, Tim Sykes' trading tips offer valuable insights into the world of penny stock trading. By focusing on penny stocks, using technical analysis, trading with a plan, managing risk, staying disciplined, continuously learning, and staying patient, traders can increase their chances of success and achieve their financial goals. Whether you're a beginner or an experienced trader, these tips can help you improve your trading skills and achieve success in the markets.

FAQs:

What is Tim Sykes' net worth?

+Tim Sykes' net worth is estimated to be over $10 million.

What type of stocks does Tim Sykes trade?

+Tim Sykes trades penny stocks, which are low-priced stocks that are often volatile and unpredictable.

What is Tim Sykes' trading strategy?

+Tim Sykes' trading strategy involves using technical analysis to identify trading opportunities, managing risk, and staying disciplined and patient.

Gallery of 7 Tim Sykes Trading Tips Revealed