As we enter a new year, it's essential for publicly traded companies to stay on top of their reporting requirements to avoid any potential penalties or fines. The Securities and Exchange Commission (SEC) requires companies to submit regular reports to keep investors informed about their financial performance and other material events. To help you stay organized, we've put together a comprehensive 2025 SEC reporting calendar, highlighting key dates and deadlines.

Why is SEC Reporting Important?

SEC reporting is crucial for maintaining transparency and accountability in the financial markets. By requiring companies to disclose their financial information, the SEC aims to protect investors and promote fair market practices. Companies that fail to comply with SEC reporting requirements can face severe consequences, including fines, penalties, and even delisting from stock exchanges.

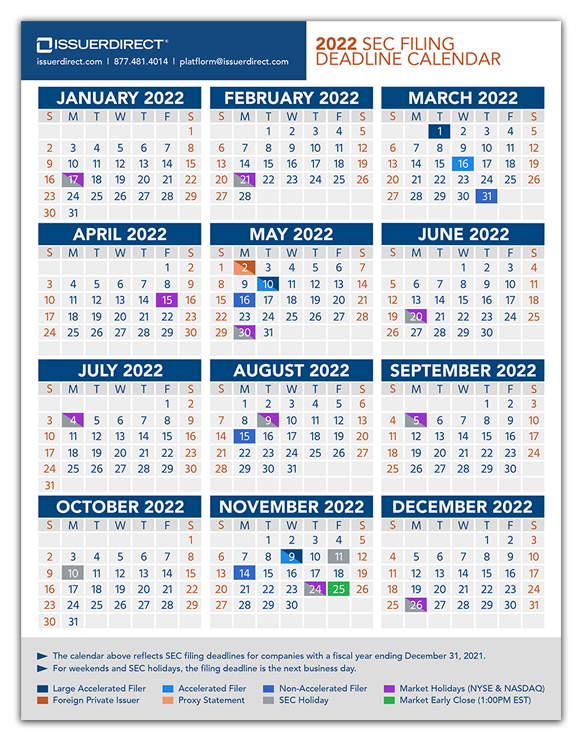

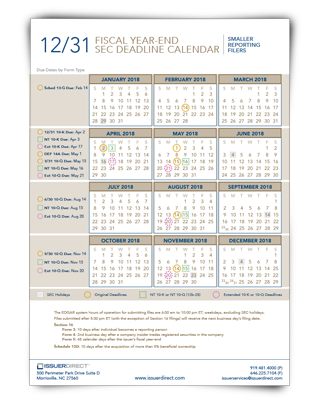

2025 SEC Reporting Calendar: Key Dates and Deadlines

Here are the key dates and deadlines for SEC reporting in 2025:

Quarterly Reporting Deadlines

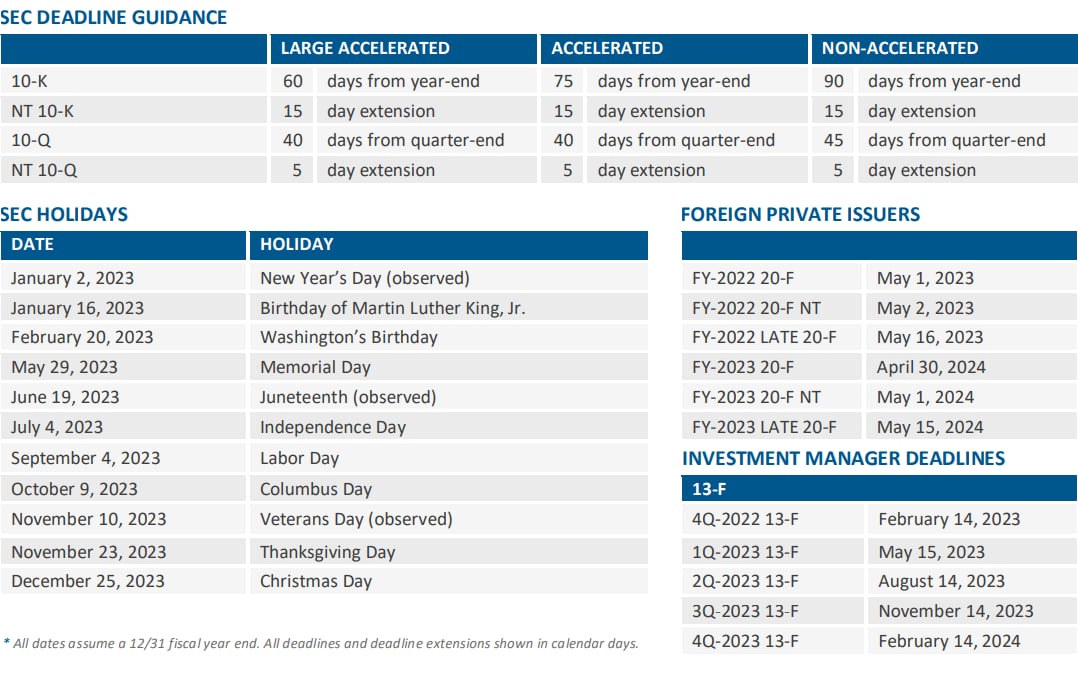

Form 10-Q: Quarterly reports are due 40 days after the end of each quarter. + Q1 2025: May 10, 2025 + Q2 2025: August 10, 2025 + Q3 2025: November 10, 2025 + Q4 2025: February 10, 2026

Annual Reporting Deadlines

Form 10-K: Annual reports are due 60 days after the end of the fiscal year. + For calendar-year-end companies: March 10, 2025 + For fiscal-year-end companies: 60 days after the end of the fiscal year

Other Reporting Deadlines

Form 8-K: Current reports are due within four business days of a material event. Form 4: Insider trading reports are due within two business days of a transaction. Form 13D: Beneficial ownership reports are due within 10 days of acquiring more than 5% of a company's outstanding shares.

Proxy Statement and Annual Meeting Deadlines

Form DEF 14A: Proxy statements are due 120 days before the annual meeting. Annual Meeting: The annual meeting must be held within 13 months of the previous year's meeting.

XBRL and EDGAR Filing Deadlines

XBRL: XBRL files are due within 24 hours of the filing deadline. EDGAR: EDGAR filings are due within 24 hours of the filing deadline.

Tips for Meeting SEC Reporting Deadlines

To avoid any potential penalties or fines, it's essential to stay organized and plan ahead. Here are some tips for meeting SEC reporting deadlines:

Create a reporting calendar: Keep track of key deadlines and milestones using a reporting calendar. Review and update your reporting process: Ensure that your reporting process is efficient and compliant with SEC regulations. Use XBRL and EDGAR filing tools: Utilize XBRL and EDGAR filing tools to streamline your reporting process. Seek professional help: Consult with a financial reporting expert or attorney to ensure compliance with SEC regulations.

SEC Reporting Requirements

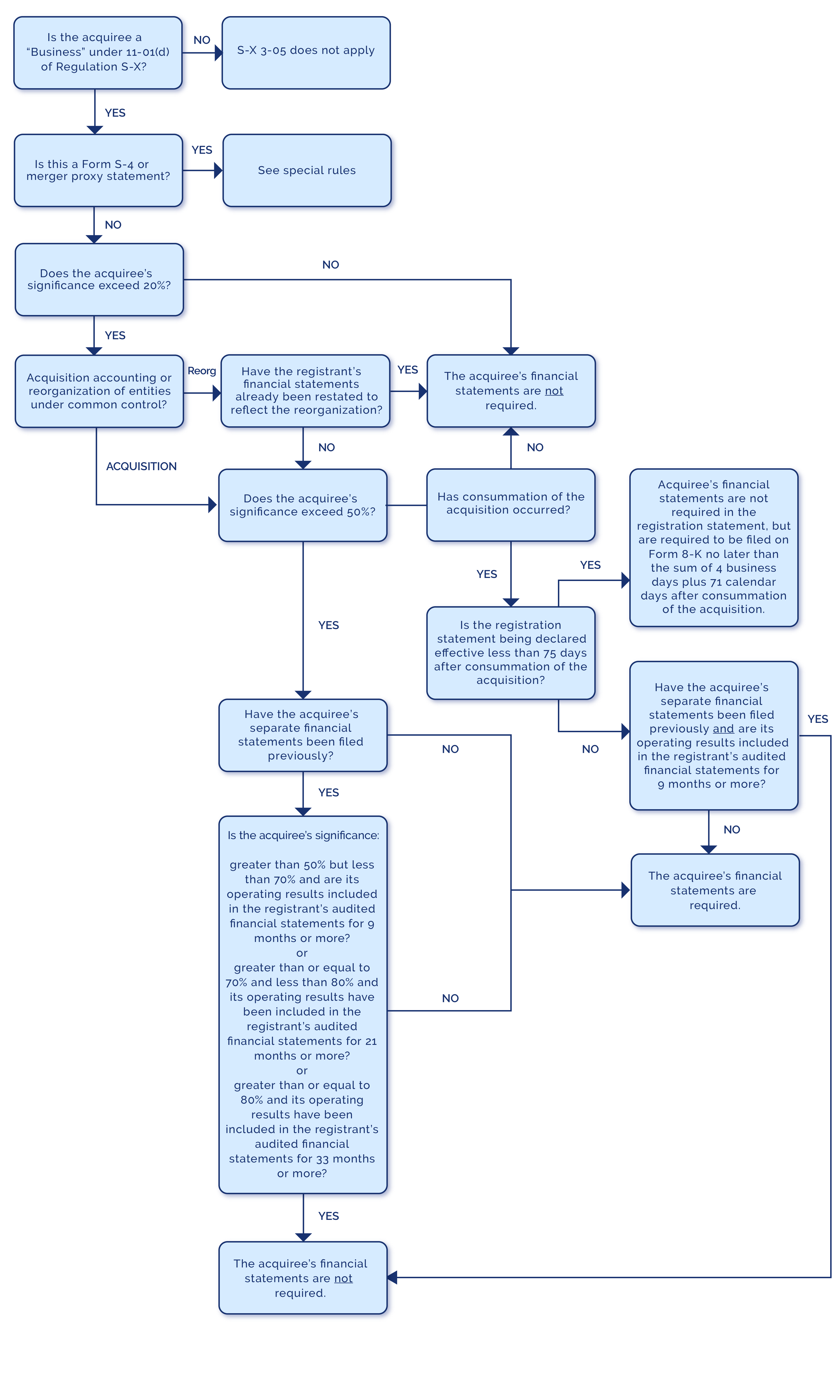

The SEC requires publicly traded companies to submit regular reports to keep investors informed about their financial performance and other material events. Here are some key SEC reporting requirements:

Form 10-K: Annual Report

The Form 10-K is an annual report that provides a comprehensive overview of a company's financial performance and business operations. The report must include:

Financial statements: Audited financial statements, including the balance sheet, income statement, and cash flow statement. Management's discussion and analysis (MD&A): A discussion of the company's financial performance and business operations. Risk factors: A discussion of the company's risk factors and uncertainties.

Form 10-Q: Quarterly Report

The Form 10-Q is a quarterly report that provides an update on a company's financial performance and business operations. The report must include:

Financial statements: Unaudited financial statements, including the balance sheet, income statement, and cash flow statement. MD&A: A discussion of the company's financial performance and business operations. Risk factors: A discussion of the company's risk factors and uncertainties.

Consequences of Non-Compliance

Companies that fail to comply with SEC reporting requirements can face severe consequences, including:

Fines and penalties: The SEC can impose fines and penalties for non-compliance. Delisting: Companies that fail to comply with SEC reporting requirements can be delisted from stock exchanges. Reputational damage: Non-compliance can damage a company's reputation and erode investor confidence.

Conclusion

In conclusion, SEC reporting is a critical aspect of maintaining transparency and accountability in the financial markets. By staying organized and planning ahead, companies can avoid potential penalties and fines associated with non-compliance. We hope this 2025 SEC reporting calendar has provided valuable insights and guidance for meeting SEC reporting deadlines.

Final Thoughts

As we enter a new year, it's essential to prioritize SEC reporting and ensure compliance with SEC regulations. By doing so, companies can maintain transparency, accountability, and investor confidence. Stay organized, plan ahead, and seek professional help when needed to ensure a smooth reporting process.

Call to Action

If you're a publicly traded company, we encourage you to review your reporting process and ensure compliance with SEC regulations. Don't hesitate to reach out to a financial reporting expert or attorney for guidance. Stay ahead of the game and maintain transparency in the financial markets.

FAQs

What is the deadline for filing Form 10-K?

+The deadline for filing Form 10-K is 60 days after the end of the fiscal year.

What is the deadline for filing Form 10-Q?

+The deadline for filing Form 10-Q is 40 days after the end of each quarter.

What are the consequences of non-compliance with SEC reporting requirements?

+Companies that fail to comply with SEC reporting requirements can face fines, penalties, delisting, and reputational damage.

Gallery of 2025 Sec Reporting Calendar: Key Dates And Deadlines