As we approach the start of Fiscal 2025, it's essential to plan and prepare for the year ahead. A well-structured fiscal calendar serves as a roadmap for businesses, organizations, and individuals to navigate the financial landscape. In this article, we'll delve into the key dates and provide a comprehensive planning guide for Fiscal 2025.

A fiscal calendar is a critical tool for managing finances, meeting deadlines, and making informed decisions. It helps individuals and organizations stay on track, avoid last-minute scrambles, and optimize their financial performance. By understanding the key dates and milestones, you can proactively plan and prepare for the upcoming fiscal year.

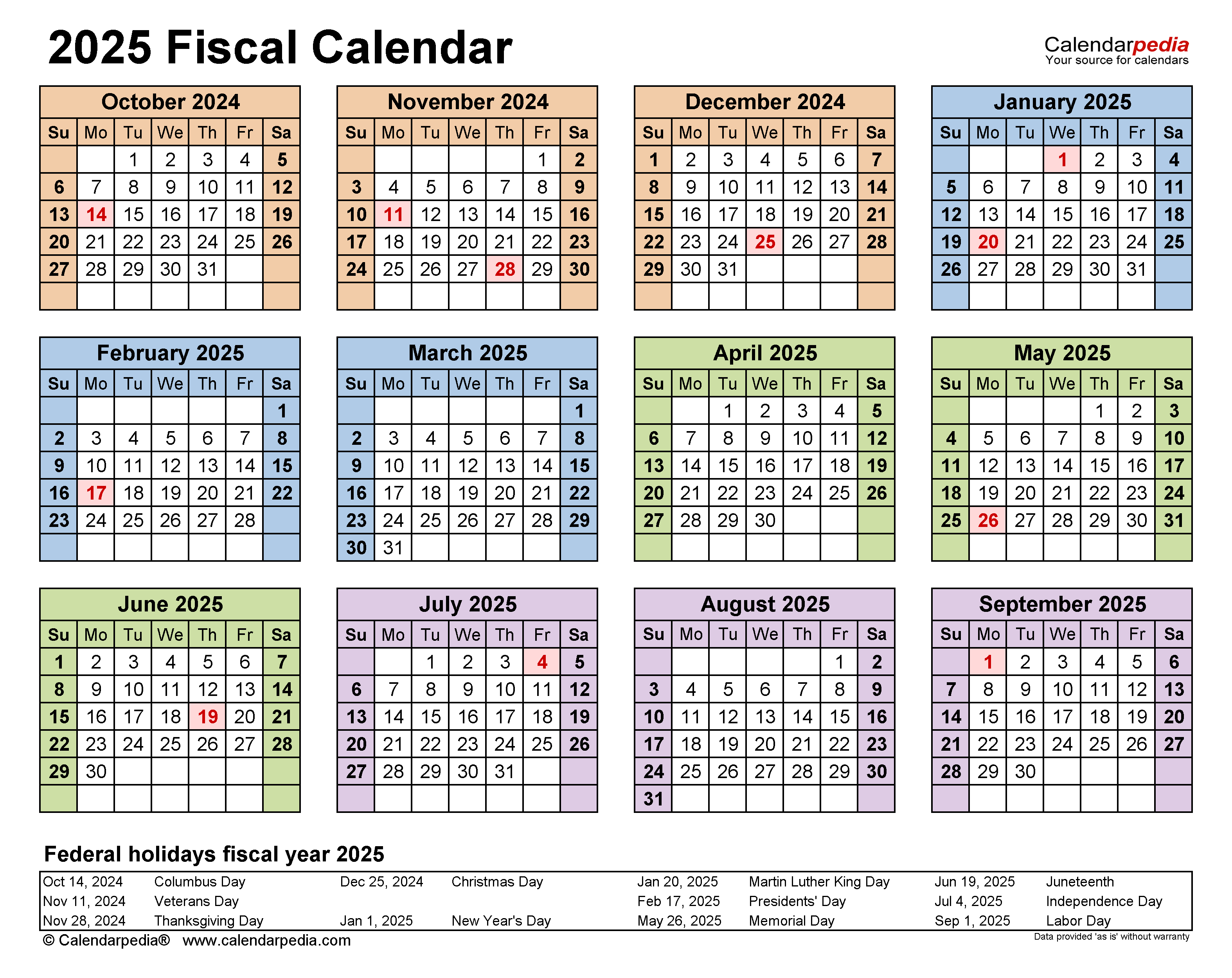

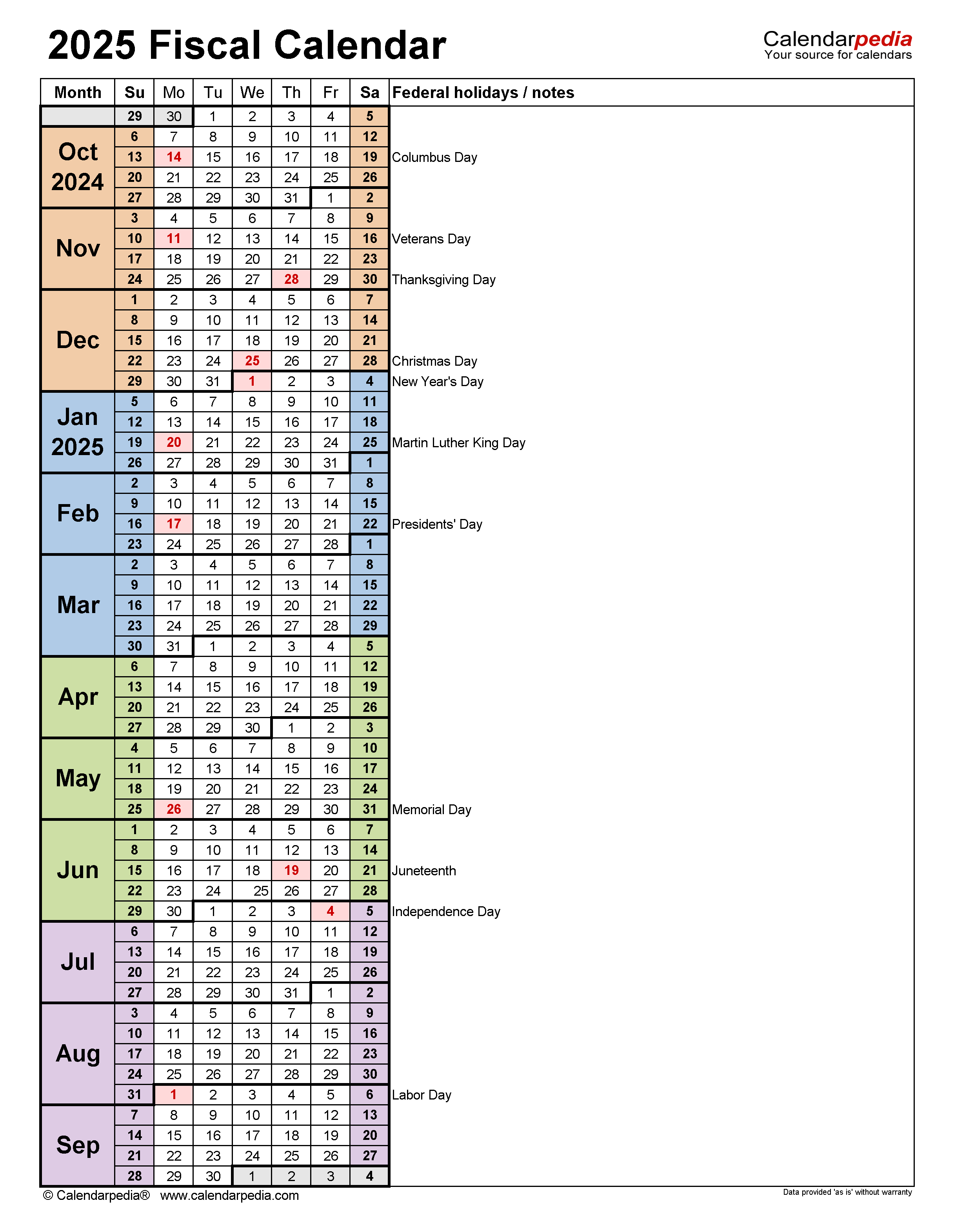

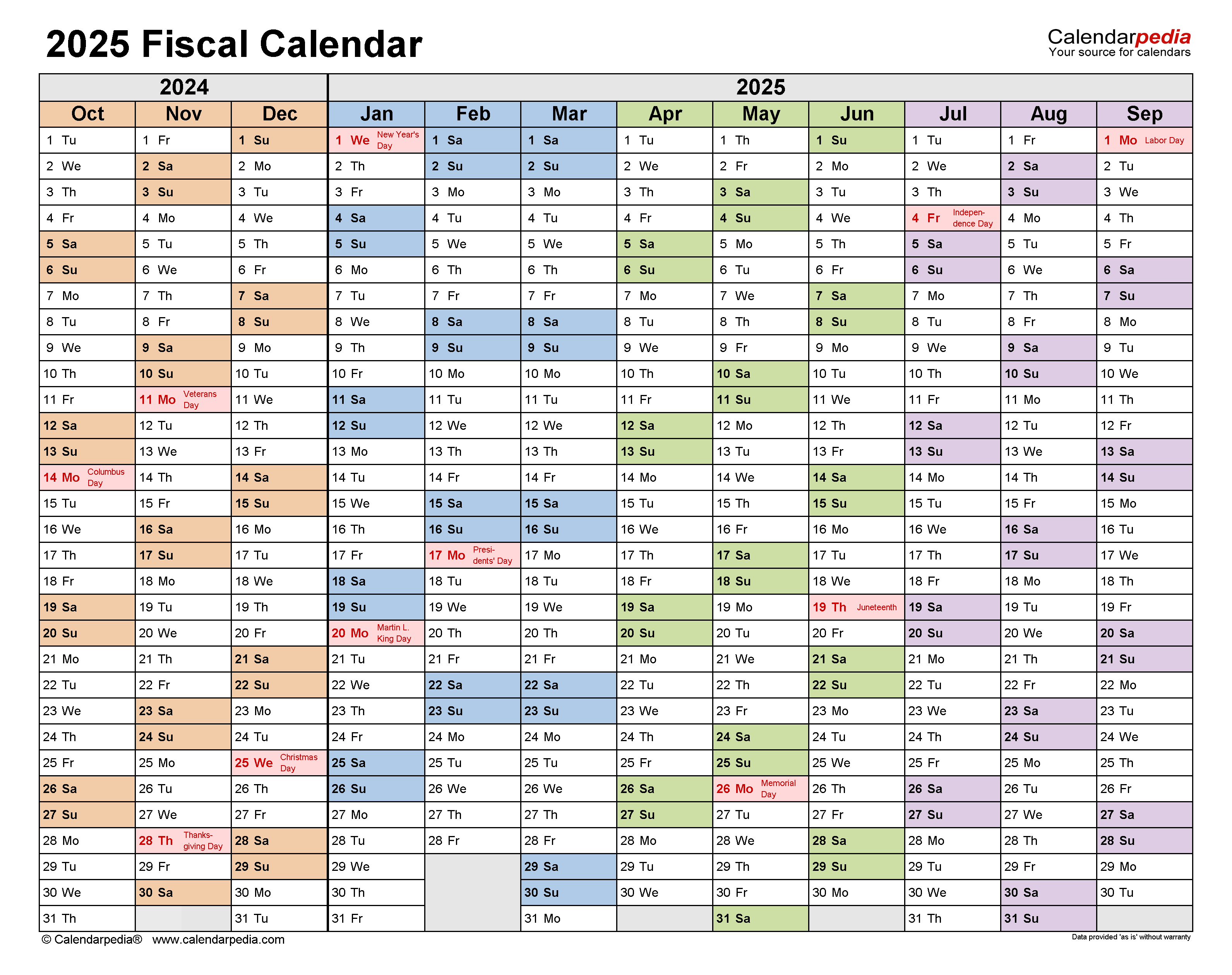

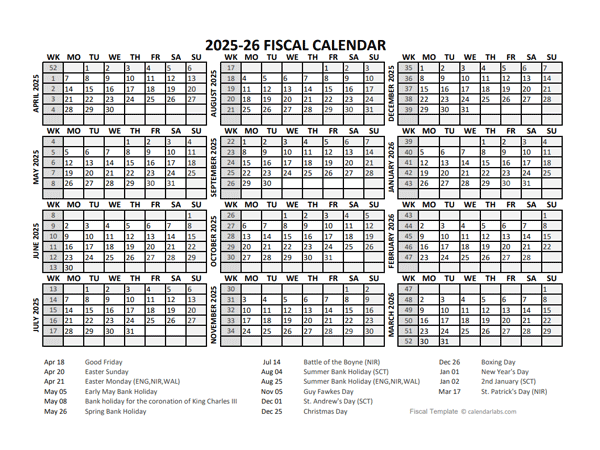

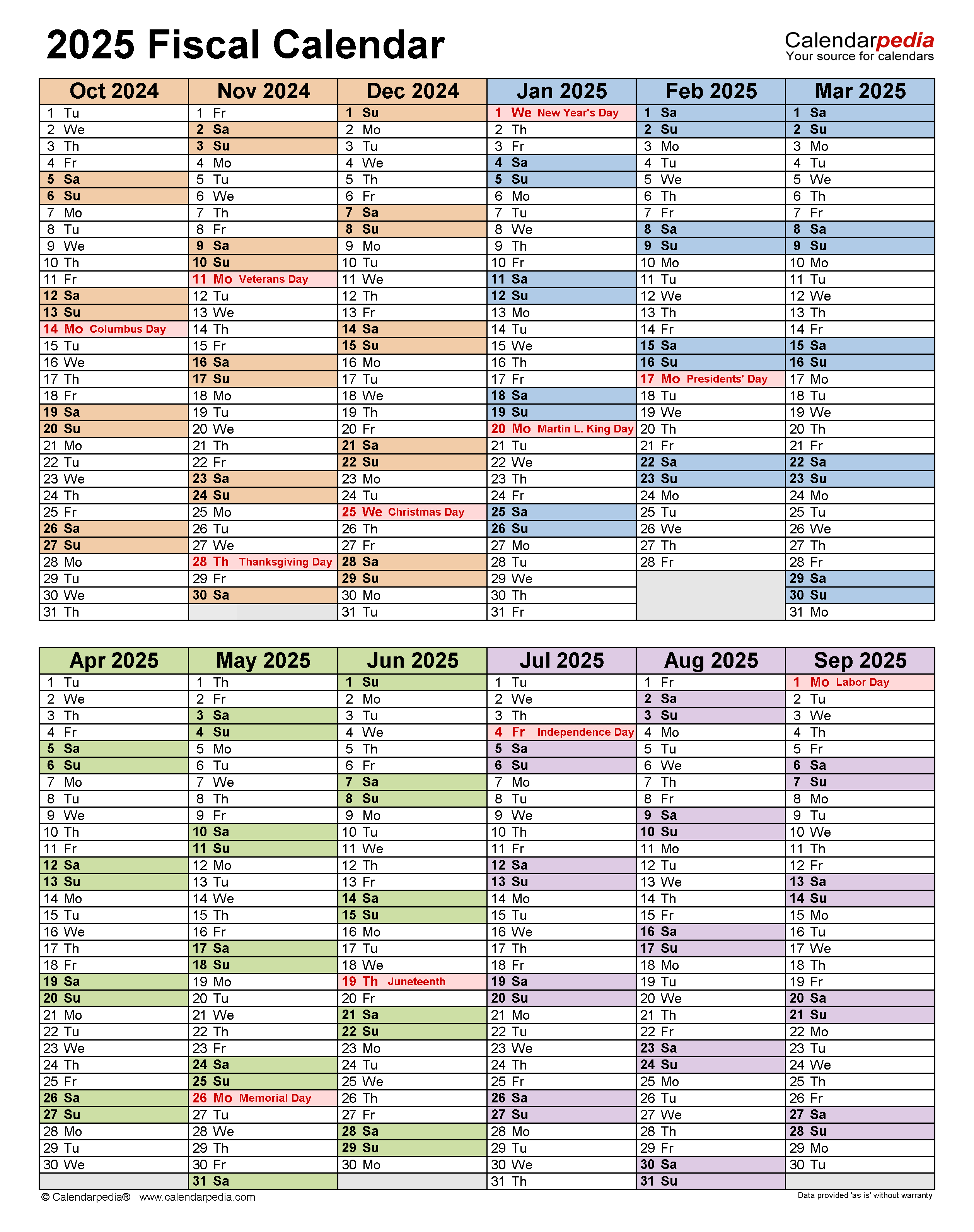

Understanding Fiscal 2025 Calendar

Fiscal 2025 begins on October 1, 2024, and ends on September 30, 2025. The fiscal calendar is divided into four quarters, each with its unique set of deadlines and milestones.

Quarter 1 (October 1, 2024 - December 31, 2024)

Quarter 1 is a critical period for planning and budgeting. Key dates include:

October 1, 2024: Start of Fiscal 2025 October 15, 2024: Deadline for filing individual tax returns (Form 1040) November 15, 2024: Deadline for filing partnership tax returns (Form 1065) December 31, 2024: End of Quarter 1

Key Planning Considerations for Fiscal 2025

As you plan for Fiscal 2025, consider the following key areas:

Budgeting: Establish a comprehensive budget that accounts for projected income and expenses. Tax Planning: Consult with a tax professional to optimize your tax strategy and minimize liabilities. Financial Goal Setting: Set specific, measurable, and achievable financial goals for the fiscal year. Risk Management: Identify potential risks and develop strategies to mitigate them.

Tax Planning Strategies for Fiscal 2025

Tax planning is an essential aspect of fiscal planning. Consider the following strategies:

Take advantage of tax deductions and credits Utilize tax-deferred savings vehicles, such as 401(k) or IRA accounts Consider charitable donations to reduce taxable income Consult with a tax professional to optimize your tax strategy

Quarter 2 (January 1, 2025 - March 31, 2025)

Quarter 2 is a critical period for tax planning and compliance. Key dates include:

January 31, 2025: Deadline for filing W-2 and 1099 forms February 15, 2025: Deadline for filing individual tax returns (Form 1040) with an automatic six-month extension March 15, 2025: Deadline for filing partnership tax returns (Form 1065) with an automatic six-month extension March 31, 2025: End of Quarter 2

Mid-Year Financial Review

As you reach the midpoint of Fiscal 2025, conduct a thorough financial review to assess your progress. Consider the following:

Review budget performance and make adjustments as needed Assess tax planning strategies and make changes if necessary Evaluate financial goal progress and make adjustments to stay on track

Quarter 3 (April 1, 2025 - June 30, 2025)

Quarter 3 is a critical period for financial planning and compliance. Key dates include:

April 15, 2025: Deadline for filing individual tax returns (Form 1040) with an automatic six-month extension May 15, 2025: Deadline for filing partnership tax returns (Form 1065) with an automatic six-month extension June 15, 2025: Deadline for filing quarterly estimated tax payments (Form 1040-ES) June 30, 2025: End of Quarter 3

Third-Quarter Financial Planning

As you enter the third quarter, consider the following financial planning strategies:

Review and adjust budget performance Evaluate tax planning strategies and make changes if necessary Assess financial goal progress and make adjustments to stay on track

Quarter 4 (July 1, 2025 - September 30, 2025)

Quarter 4 is a critical period for year-end financial planning and compliance. Key dates include:

July 15, 2025: Deadline for filing quarterly estimated tax payments (Form 1040-ES) August 15, 2025: Deadline for filing partnership tax returns (Form 1065) with an automatic six-month extension September 15, 2025: Deadline for filing individual tax returns (Form 1040) with an automatic six-month extension September 30, 2025: End of Fiscal 2025

Year-End Financial Review

As you approach the end of Fiscal 2025, conduct a thorough financial review to assess your progress. Consider the following:

Review budget performance and make adjustments as needed Assess tax planning strategies and make changes if necessary Evaluate financial goal progress and make adjustments to stay on track

Final Thoughts and Next Steps:

Fiscal 2025 is just around the corner, and it's essential to plan and prepare for the year ahead. By understanding the key dates and milestones, you can proactively plan and prepare for the upcoming fiscal year. Remember to review and adjust your budget, tax planning strategies, and financial goals regularly to ensure you stay on track.

We encourage you to share your thoughts and experiences with fiscal planning in the comments below. What strategies do you use to stay on track? What challenges do you face, and how do you overcome them? Let's work together to achieve our financial goals in Fiscal 2025.

FAQs:

What is the start date of Fiscal 2025?

+Fiscal 2025 begins on October 1, 2024.

What are the key dates for Quarter 1 of Fiscal 2025?

+Key dates for Quarter 1 include October 1, 2024 (start of Fiscal 2025), October 15, 2024 (deadline for filing individual tax returns), and December 31, 2024 (end of Quarter 1).

What is the deadline for filing partnership tax returns (Form 1065) with an automatic six-month extension?

+The deadline for filing partnership tax returns (Form 1065) with an automatic six-month extension is May 15, 2025.

Gallery of Fiscal 2025 Calendar: Key Dates And Planning Guide