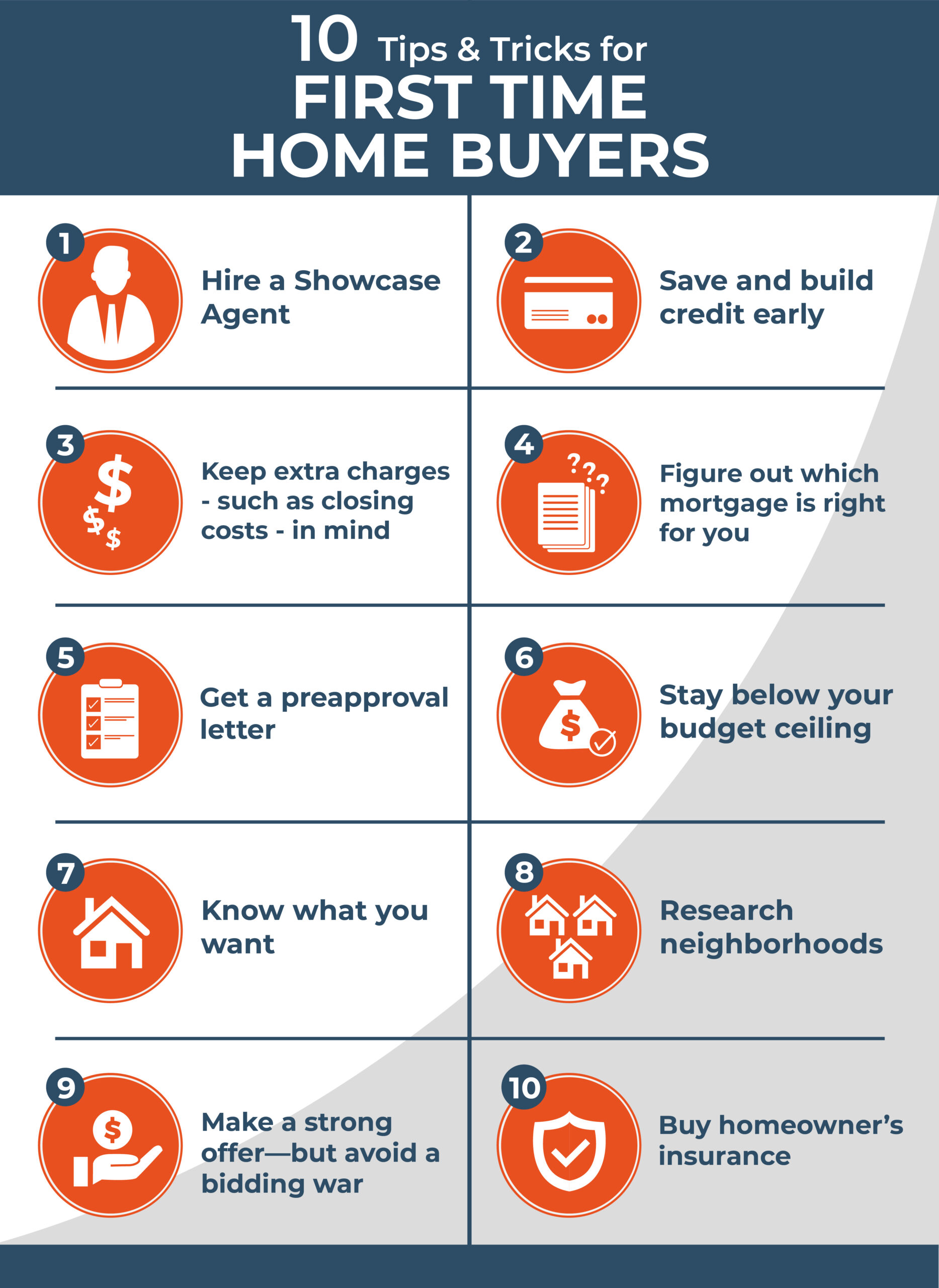

Congratulations on considering purchasing your first home in Georgia! This exciting milestone requires careful planning, research, and execution. As a first-time homebuyer, it's essential to understand the process and make informed decisions to ensure a smooth and successful transaction. Here's a comprehensive 7-step guide to help you navigate the journey:

Step 1: Check Your Finances

Before starting your home search, it's crucial to assess your financial situation. Calculate your income, expenses, debts, and savings to determine how much home you can afford. Consider factors such as:

Credit score: Aim for a score of 700 or higher to qualify for better interest rates. Savings: You'll need money for a down payment, closing costs, and ongoing expenses like mortgage payments, property taxes, and insurance. Debt-to-income ratio: Keep your debt payments below 36% of your gross income. Income stability: Ensure you have a stable job and a steady income.

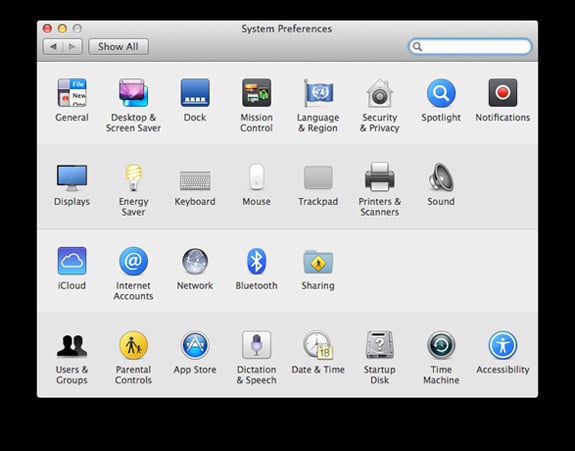

Recommended Financial Tools:

Credit score check: Use services like Credit Karma, Credit Sesame, or Experian to monitor your credit score. Budgeting apps: Utilize apps like Mint, You Need a Budget (YNAB), or Personal Capital to track your expenses and create a budget.

Step 2: Get Pre-Approved for a Mortgage

Getting pre-approved for a mortgage provides you with a clear understanding of how much you can borrow and what your monthly payments will be. This step also makes you a more attractive buyer to sellers. To get pre-approved:

Research and compare mortgage rates and terms from various lenders. Gather required documents, such as pay stubs, bank statements, and tax returns. Submit your application and await the lender's decision.

Recommended Mortgage Options:

Fixed-rate mortgage: Offers stable monthly payments and protection from rising interest rates. Adjustable-rate mortgage: May provide lower initial interest rates, but be aware of potential rate increases.

Step 3: Identify Your Home Preferences

Consider what you need and want in a home. Think about factors such as:

Location: Proximity to work, schools, public transportation, and amenities. Size and layout: Number of bedrooms and bathrooms, square footage, and overall design. Amenities: Pool, yard, garage, and other features that matter to you. Community: Safety, noise level, and neighborhood dynamics.

Recommended Home Search Tools:

Online real estate platforms: Websites like Zillow, Redfin, and Realtor.com can help you browse listings and filter by preferences. Local real estate agents: Work with an agent familiar with the area and market conditions.

Step 4: Find the Right Neighborhood

The neighborhood you choose can significantly impact your quality of life and resale value. Research the area to ensure it aligns with your needs and preferences. Consider factors such as:

Schools: Quality of local schools and school districts. Safety: Crime rates and local law enforcement presence. Commute: Accessibility to public transportation and major highways. Amenities: Proximity to parks, grocery stores, restaurants, and entertainment.

Recommended Neighborhood Research Tools:

Online reviews: Websites like Niche and GreatSchools provide insights into local schools and neighborhoods. Local government websites: Visit official city and county websites for information on zoning, crime rates, and community events.

Step 5: Visit Potential Homes

Once you've narrowed down your options, it's time to visit potential homes. Pay attention to:

Condition: Note any needed repairs or updates. Layout: Ensure the floor plan meets your needs. Natural light: Consider the amount of natural light and its impact on the ambiance. Resale value: Think about how easily the home could be sold in the future.

Recommended Home Viewing Tips:

Take notes and photos to compare properties. Inspect the property thoroughly, including the attic, basement, and outdoor spaces. Don't rush – take your time to evaluate each property.

Step 6: Make an Offer and Negotiate

When you find the right home, it's time to make an offer. Work with your agent to:

Determine a fair price based on market conditions and the home's value. Create a competitive offer that includes contingencies and terms. Negotiate with the seller to reach a mutually agreeable price.

Recommended Negotiation Strategies:

Be respectful and open-minded during negotiations. Consider including a home inspection contingency to ensure the property is in good condition. Don't be afraid to walk away if the terms aren't in your favor.

Step 7: Close the Deal

Once your offer is accepted, it's time to close the deal. This involves:

Finalizing financing and completing any remaining paperwork. Conducting a final walk-through to ensure the property is in the expected condition. Transferring ownership and receiving the keys to your new home.

Recommended Closing Tips:

Review all documents carefully before signing. Ensure you understand the terms and conditions of the sale. Don't hesitate to ask questions or seek clarification if needed.

By following these 7 steps, you'll be well on your way to becoming a successful first-time homebuyer in Georgia. Remember to stay patient, persistent, and informed throughout the process. Good luck!

What is the average home price in Georgia?

+The average home price in Georgia varies depending on the location, with cities like Atlanta and Savannah tend to be more expensive than smaller towns and rural areas. According to Zillow, the median home value in Georgia is around $240,000.

What are the typical closing costs for a homebuyer in Georgia?

+Closing costs for a homebuyer in Georgia typically range from 2% to 5% of the purchase price. These costs may include title insurance, appraisal fees, and attorney fees.

Are there any programs available to help first-time homebuyers in Georgia?

+Yes, there are several programs available to help first-time homebuyers in Georgia, such as the Georgia Dream Homeownership Program, which offers down payment assistance and other benefits.

Gallery of 7 Steps To Buying Your First Home In Ga

![7 Steps to Becoming a Homeowner [infographic]](https://i.pinimg.com/originals/6f/45/5c/6f455c5d402b969dc7c3595affe92e9c.png)

:max_bytes(150000):strip_icc()/tips-for-buying-your-first-home-1798337-color-v02-d6b6a9f0efda4a0fa44fb23e7665ac7f.png)