As the world of finance and accounting continues to evolve, staying up-to-date with the latest regulatory requirements and deadlines is crucial for businesses and professionals alike. In this article, we'll delve into the 2025 SEC reporting calendar, highlighting key dates and deadlines that you need to know.

The Securities and Exchange Commission (SEC) plays a vital role in maintaining fair and transparent markets, and its reporting requirements are designed to ensure that investors have access to accurate and timely information. Whether you're a publicly traded company, a financial institution, or an investment professional, understanding the SEC reporting calendar is essential for compliance and success.

Overview of the SEC Reporting Calendar

The SEC reporting calendar is a comprehensive guide to the various deadlines and requirements for submitting reports, statements, and other documents to the SEC. The calendar is designed to help companies and individuals navigate the complex regulatory landscape and avoid potential pitfalls.

Key Dates and Deadlines for 2025

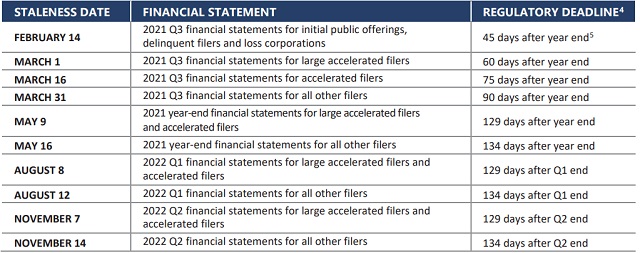

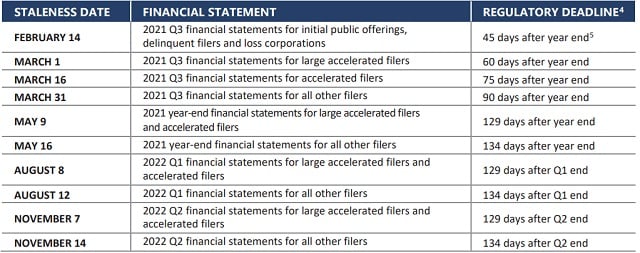

Here are some of the key dates and deadlines for the 2025 SEC reporting calendar:

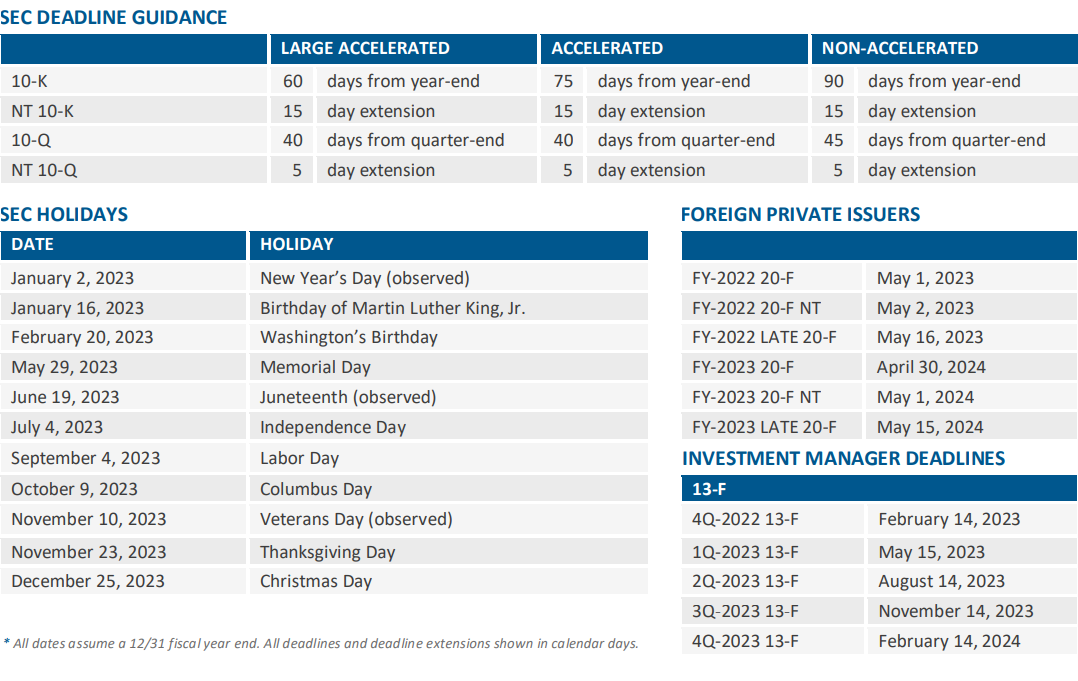

January 15, 2025: Deadline for submitting annual reports (Form 10-K) for companies with a fiscal year-end of October 31, 2024. February 14, 2025: Deadline for submitting quarterly reports (Form 10-Q) for companies with a fiscal quarter-end of November 30, 2024. March 17, 2025: Deadline for submitting annual reports (Form 10-K) for companies with a fiscal year-end of December 31, 2024. April 15, 2025: Deadline for submitting quarterly reports (Form 10-Q) for companies with a fiscal quarter-end of January 31, 2025. May 15, 2025: Deadline for submitting quarterly reports (Form 10-Q) for companies with a fiscal quarter-end of February 28, 2025. June 15, 2025: Deadline for submitting quarterly reports (Form 10-Q) for companies with a fiscal quarter-end of March 31, 2025. July 15, 2025: Deadline for submitting quarterly reports (Form 10-Q) for companies with a fiscal quarter-end of April 30, 2025. August 14, 2025: Deadline for submitting quarterly reports (Form 10-Q) for companies with a fiscal quarter-end of May 31, 2025. September 16, 2025: Deadline for submitting quarterly reports (Form 10-Q) for companies with a fiscal quarter-end of June 30, 2025. October 15, 2025: Deadline for submitting quarterly reports (Form 10-Q) for companies with a fiscal quarter-end of July 31, 2025. November 14, 2025: Deadline for submitting quarterly reports (Form 10-Q) for companies with a fiscal quarter-end of August 31, 2025. December 15, 2025: Deadline for submitting quarterly reports (Form 10-Q) for companies with a fiscal quarter-end of September 30, 2025.

Understanding SEC Reporting Requirements

The SEC reporting requirements are designed to provide transparency and accountability in the financial markets. Companies and individuals are required to submit various reports and statements to the SEC, including:

Form 10-K: Annual report that provides a comprehensive overview of a company's financial performance and operations. Form 10-Q: Quarterly report that provides an update on a company's financial performance and operations. Form 8-K: Current report that provides information on significant events or transactions that may affect a company's financial performance or operations. Form 4: Statement of changes in beneficial ownership that provides information on the ownership interests of a company's officers, directors, and principal shareholders.

Penalties for Non-Compliance

Failure to comply with the SEC reporting requirements can result in significant penalties, including:

Fines: Up to $1 million per day for each day of non-compliance. Civil penalties: Up to $2.5 million per violation. Criminal penalties: Up to $5 million per violation and imprisonment for up to 20 years.

Best Practices for SEC Reporting Compliance

To ensure compliance with the SEC reporting requirements, companies and individuals should follow these best practices:

Establish a compliance calendar: Keep track of important deadlines and requirements. Review and update reports: Ensure that reports are accurate and complete. Seek professional advice: Consult with attorneys, accountants, and other professionals as needed. Monitor regulatory changes: Stay up-to-date with changes in SEC regulations and requirements.

Conclusion

The 2025 SEC reporting calendar is a critical resource for companies and individuals who need to navigate the complex regulatory landscape. By understanding the key dates and deadlines, reporting requirements, and penalties for non-compliance, businesses and professionals can ensure compliance and avoid potential pitfalls. Remember to establish a compliance calendar, review and update reports, seek professional advice, and monitor regulatory changes to stay ahead of the game.

We hope this article has provided you with valuable insights into the 2025 SEC reporting calendar. If you have any questions or comments, please feel free to share them below. Don't forget to bookmark this page and check back regularly for updates and new information.

What is the SEC reporting calendar?

+The SEC reporting calendar is a comprehensive guide to the various deadlines and requirements for submitting reports, statements, and other documents to the SEC.

What are the key dates and deadlines for the 2025 SEC reporting calendar?

+Some of the key dates and deadlines for the 2025 SEC reporting calendar include January 15, 2025, for submitting annual reports (Form 10-K) for companies with a fiscal year-end of October 31, 2024, and February 14, 2025, for submitting quarterly reports (Form 10-Q) for companies with a fiscal quarter-end of November 30, 2024.

What are the penalties for non-compliance with SEC reporting requirements?

+Failure to comply with the SEC reporting requirements can result in significant penalties, including fines, civil penalties, and criminal penalties.

Gallery of 2025 Sec Reporting Calendar Dates And Deadlines