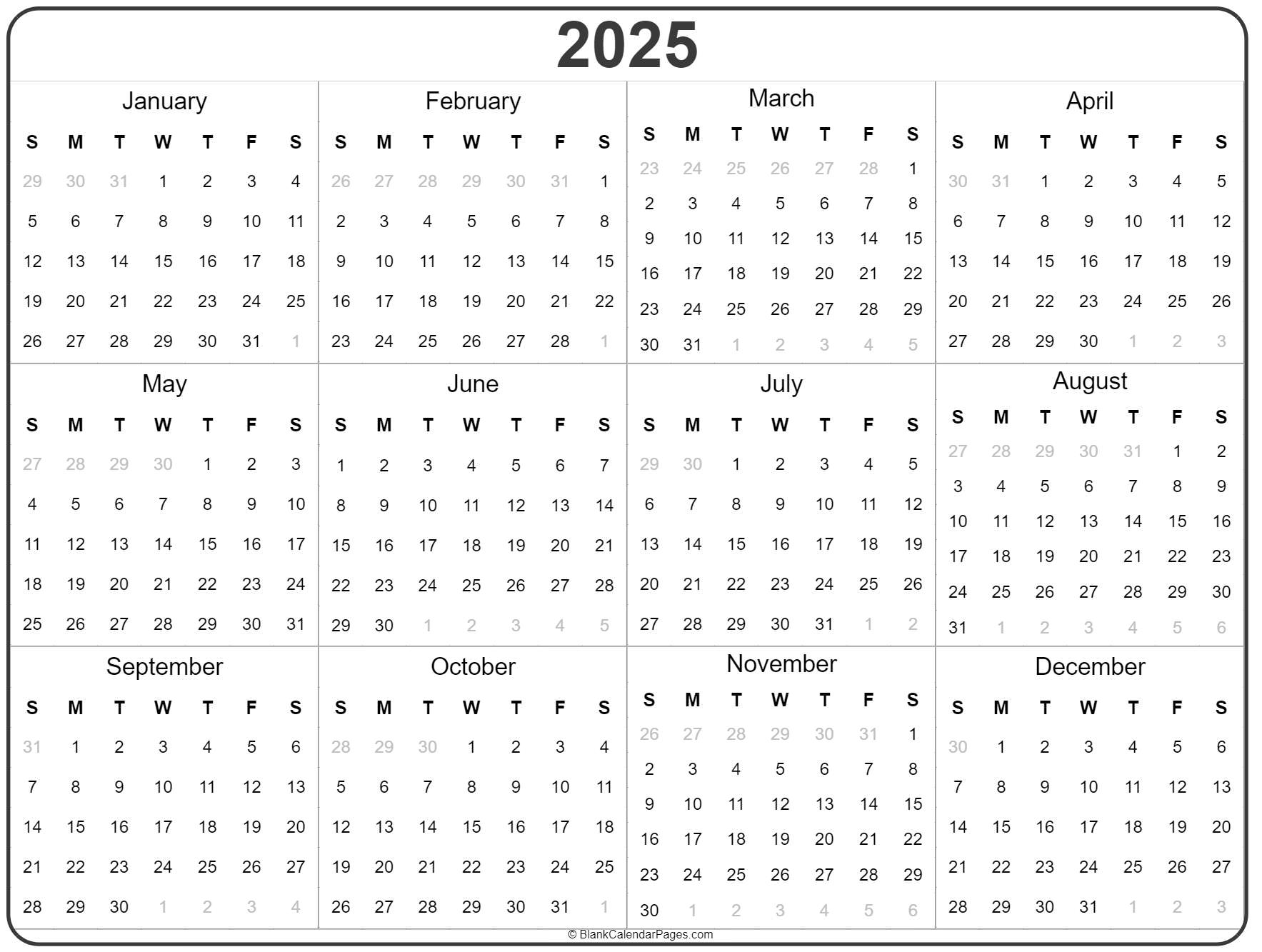

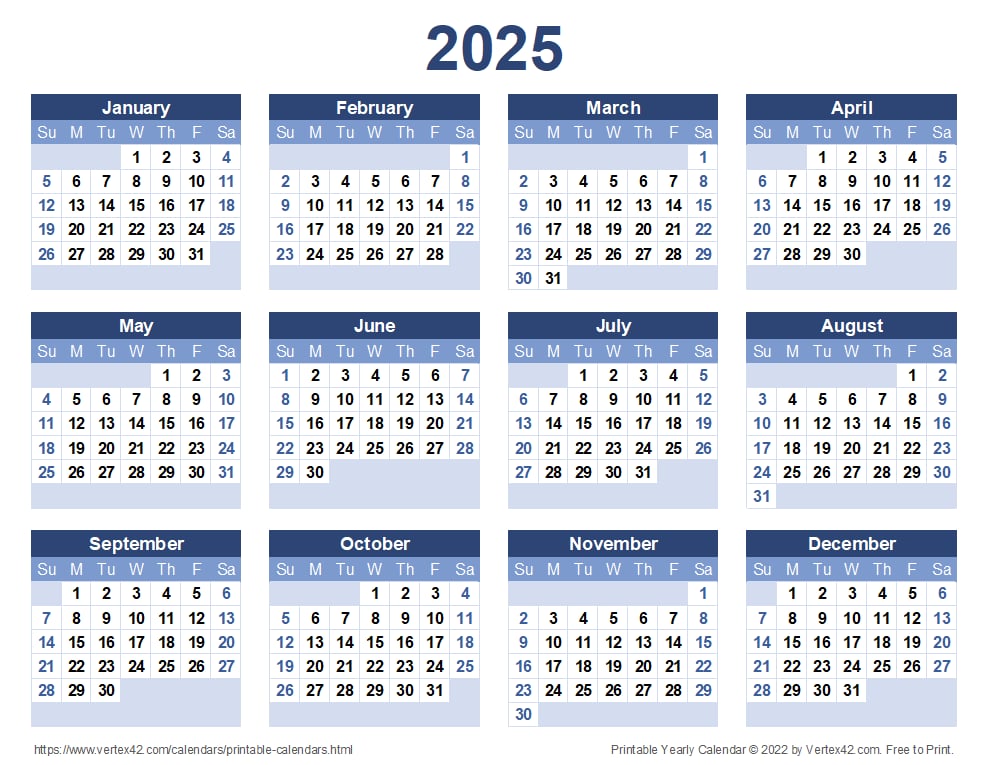

As the new year begins, it's essential to stay on top of important financial dates to ensure a smooth and successful financial year. The 2025 financial year calendar is packed with crucial deadlines, events, and milestones that can impact your financial planning, taxes, and overall economic well-being. In this article, we'll highlight the top 10 key dates to mark on your calendar, providing you with a comprehensive guide to navigate the upcoming financial year.

Staying Ahead of the Financial Curve

In today's fast-paced economic landscape, staying informed and prepared is crucial for making informed decisions about your finances. By knowing the key dates and events in the 2025 financial year calendar, you can:

Avoid costly penalties and fines Maximize tax benefits and refunds Make informed investment decisions Plan for major financial milestones, such as retirement or buying a home

10 Key Dates to Mark on Your Calendar

Here are the top 10 key dates to mark on your 2025 financial year calendar:

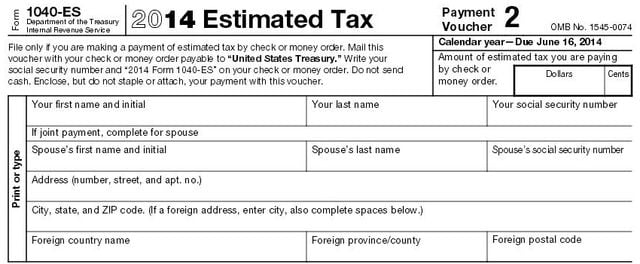

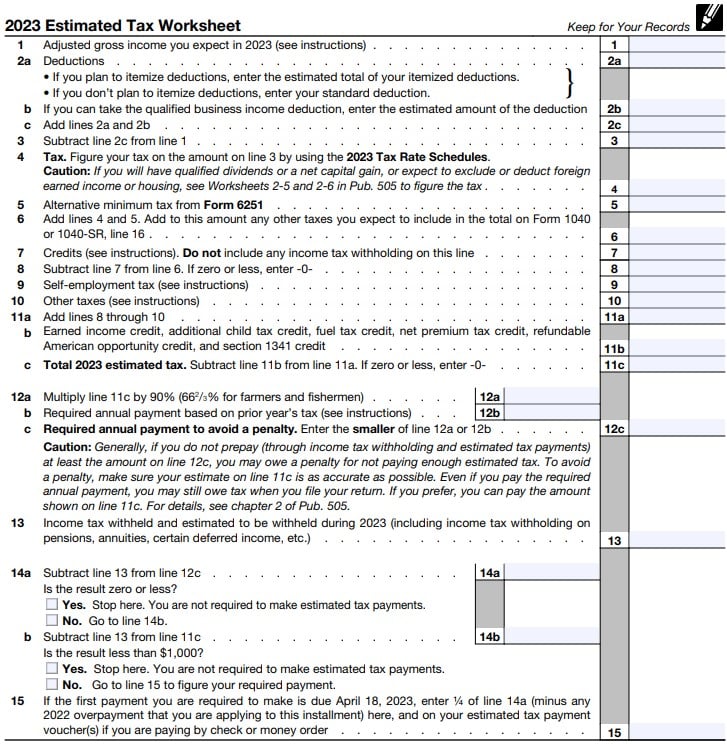

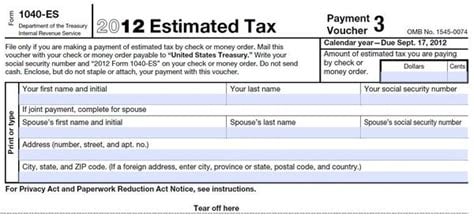

1. January 15, 2025: Quarterly Estimated Tax Payments Due

The first quarterly estimated tax payment for the 2025 financial year is due on January 15, 2025. This is a crucial date for individuals and businesses that need to make estimated tax payments to avoid penalties and fines.

What You Need to Know

Estimated tax payments are due on a quarterly basis Payments can be made online, by phone, or by mail Failure to make timely payments can result in penalties and interest

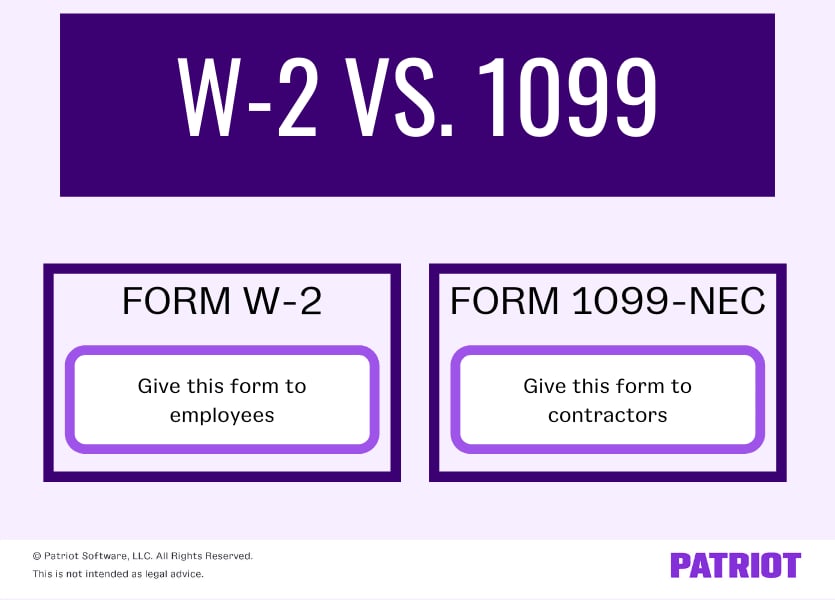

2. January 31, 2025: W-2 and 1099 Forms Due

Employers must provide W-2 forms to employees and 1099 forms to contractors by January 31, 2025. This is a critical date for tax preparation and planning.

What You Need to Know

W-2 forms report employee wages and taxes withheld 1099 forms report contractor income and taxes withheld Forms must be provided to employees and contractors by January 31, 2025

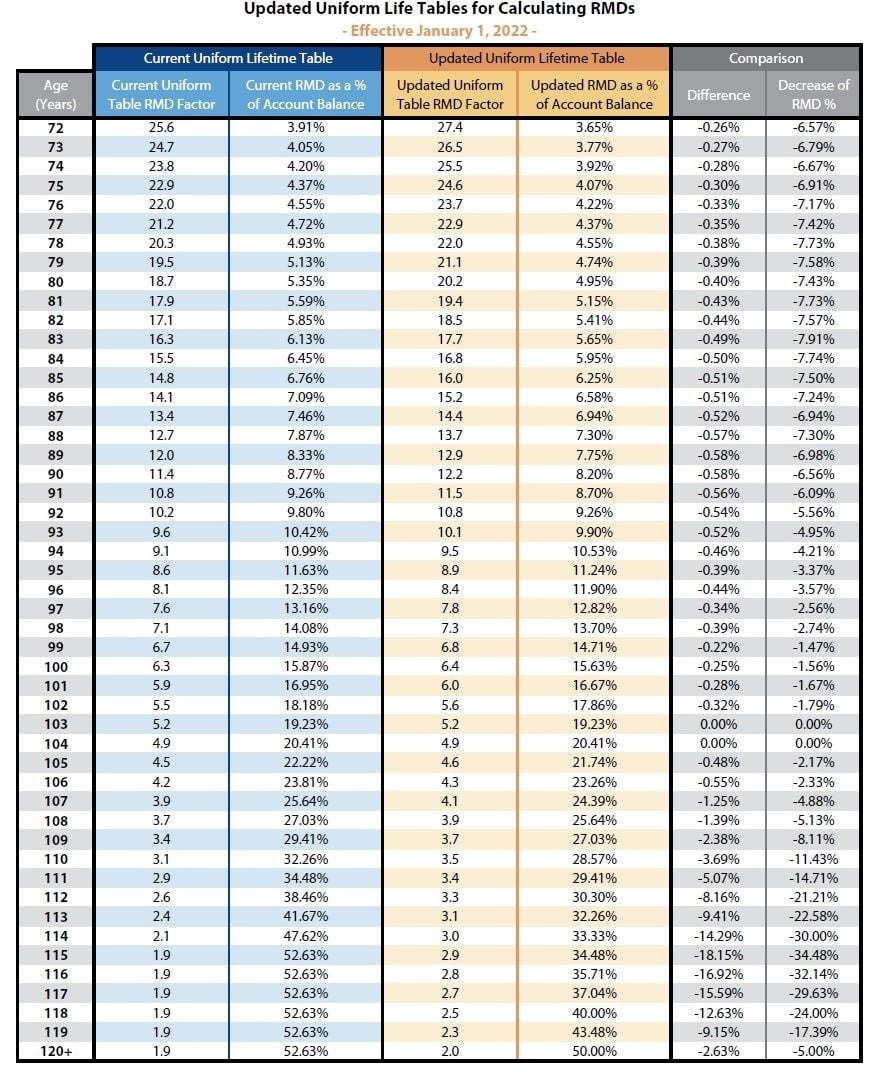

3. February 1, 2025: Required Minimum Distribution (RMD) Due

The Required Minimum Distribution (RMD) for retirement accounts, such as 401(k) and IRA accounts, is due on February 1, 2025.

What You Need to Know

RMD is the minimum amount that must be withdrawn from retirement accounts each year RMD applies to individuals aged 72 and older Failure to take RMD can result in penalties and fines

4. March 15, 2025: Partnership Tax Returns Due

Partnership tax returns, Form 1065, are due on March 15, 2025.

What You Need to Know

Partnership tax returns must be filed by March 15, 2025 Partnerships must provide Schedule K-1 forms to partners by March 15, 2025 Failure to file partnership tax returns can result in penalties and fines

5. April 15, 2025: Individual Tax Returns Due

Individual tax returns, Form 1040, are due on April 15, 2025.

What You Need to Know

Individual tax returns must be filed by April 15, 2025 Failure to file individual tax returns can result in penalties and fines Extensions can be filed to delay the filing deadline

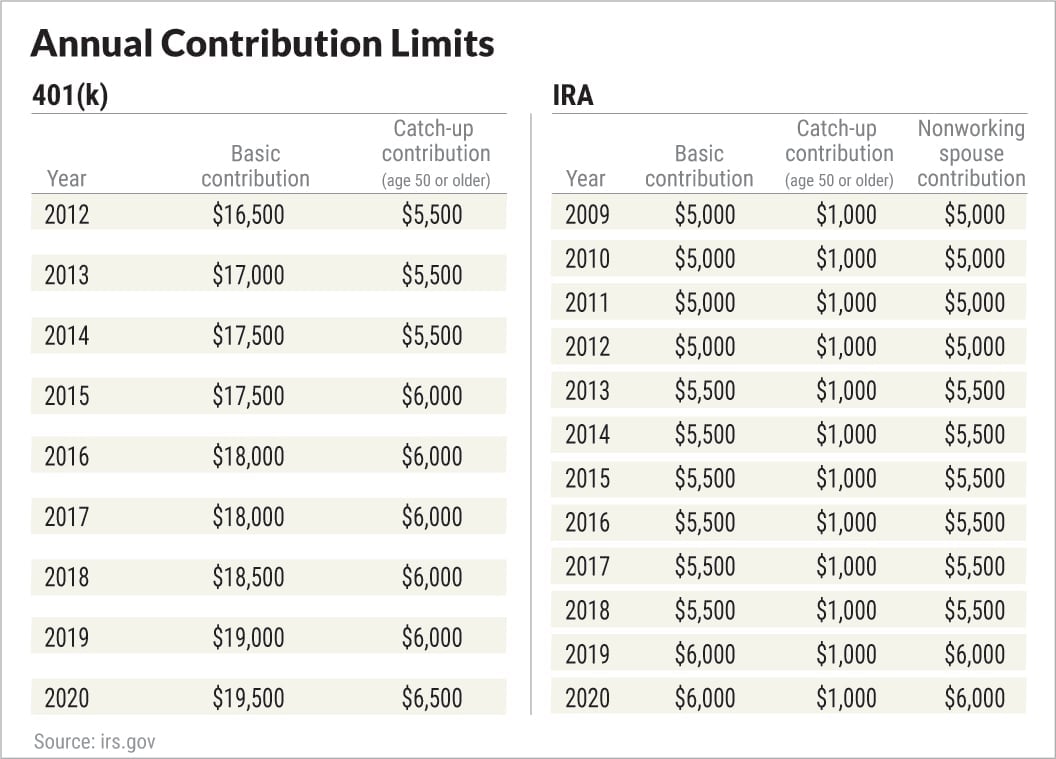

6. May 1, 2025: IRA Contributions Due

IRA contributions for the 2024 tax year are due on May 1, 2025.

What You Need to Know

IRA contributions can be made until May 1, 2025 Contributions can be made to traditional or Roth IRA accounts Contributions may be tax-deductible

7. June 15, 2025: Second-Quarter Estimated Tax Payments Due

The second-quarter estimated tax payment for the 2025 financial year is due on June 15, 2025.

What You Need to Know

Estimated tax payments are due on a quarterly basis Payments can be made online, by phone, or by mail Failure to make timely payments can result in penalties and fines

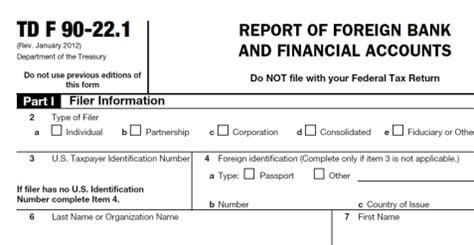

8. July 31, 2025: FBAR Filing Deadline

The FBAR (FinCEN Form 114) filing deadline for reporting foreign financial accounts is July 31, 2025.

What You Need to Know

FBAR must be filed by July 31, 2025 Failure to file FBAR can result in penalties and fines FBAR is required for individuals with foreign financial accounts exceeding $10,000

9. September 15, 2025: Third-Quarter Estimated Tax Payments Due

The third-quarter estimated tax payment for the 2025 financial year is due on September 15, 2025.

What You Need to Know

Estimated tax payments are due on a quarterly basis Payments can be made online, by phone, or by mail Failure to make timely payments can result in penalties and fines

10. December 31, 2025: Year-End Financial Planning Deadline

The year-end financial planning deadline for the 2025 financial year is December 31, 2025.

What You Need to Know

Year-end financial planning is crucial for maximizing tax benefits and minimizing liabilities Review and update financial plans, including investment portfolios and retirement accounts Consult with a financial advisor to ensure compliance with tax laws and regulations

Conclusion: Stay Ahead of the Financial Curve

By marking these 10 key dates on your 2025 financial year calendar, you'll be well-prepared to navigate the complex world of finance and taxation. Remember to stay informed, plan ahead, and consult with a financial advisor to ensure you're making the most of your financial opportunities. Don't miss out on crucial deadlines, and take control of your financial future today!

Call to Action: Share Your Thoughts!

We'd love to hear from you! Share your thoughts on the 2025 financial year calendar and how you're preparing for the upcoming year. Leave a comment below, and let's start a conversation about financial planning and success.

FAQs

What is the deadline for filing individual tax returns?

+Individual tax returns, Form 1040, are due on April 15, 2025.

What is the deadline for making estimated tax payments?

+Estimated tax payments are due on a quarterly basis, with deadlines on April 15, June 15, September 15, and January 15 of the following year.

What is the deadline for filing FBAR?

+FBAR (FinCEN Form 114) must be filed by July 31, 2025.

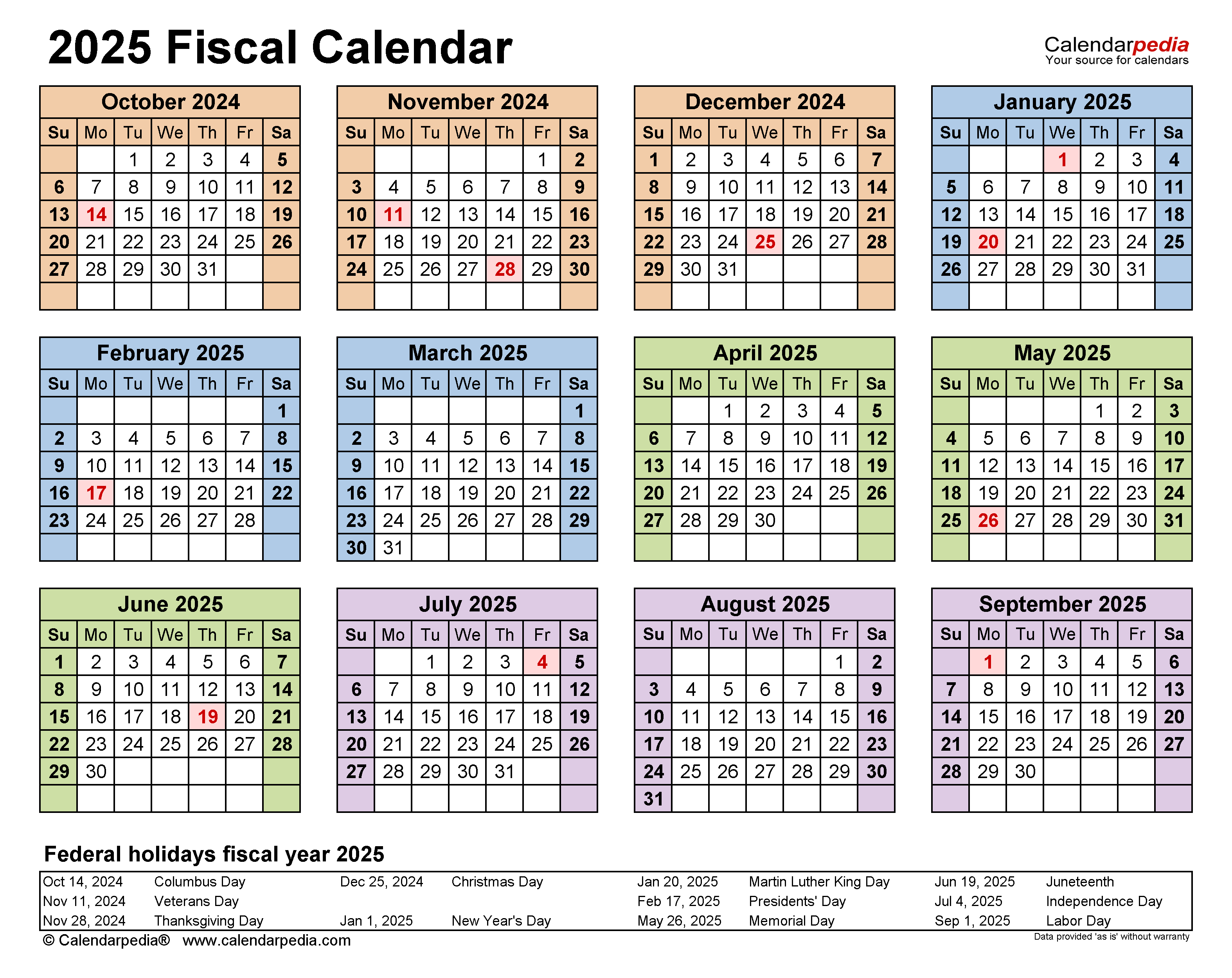

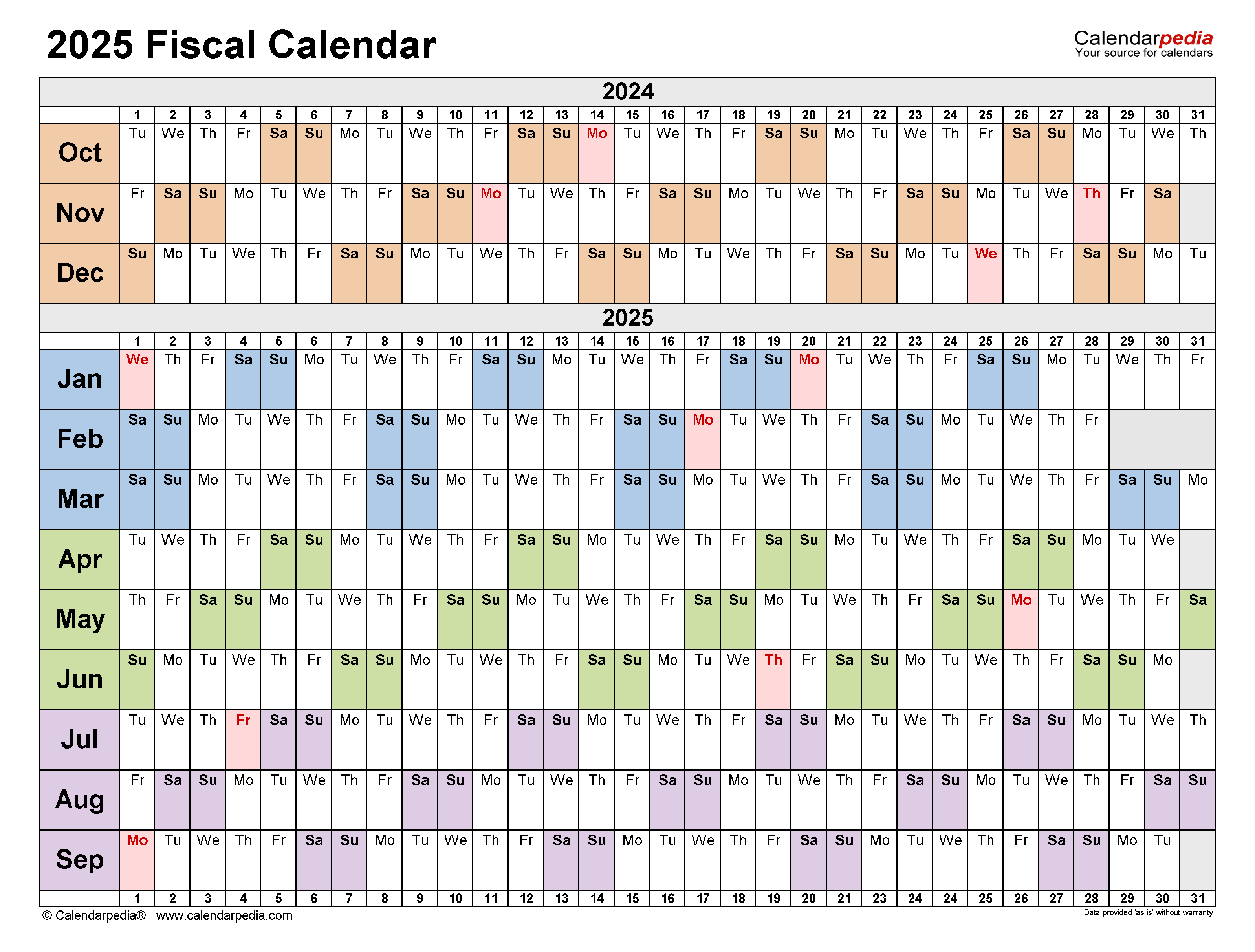

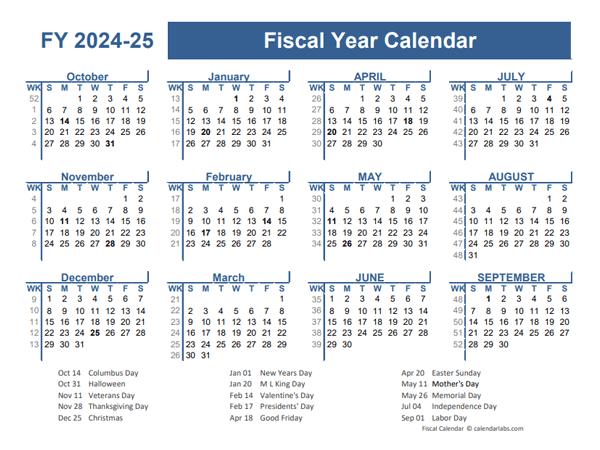

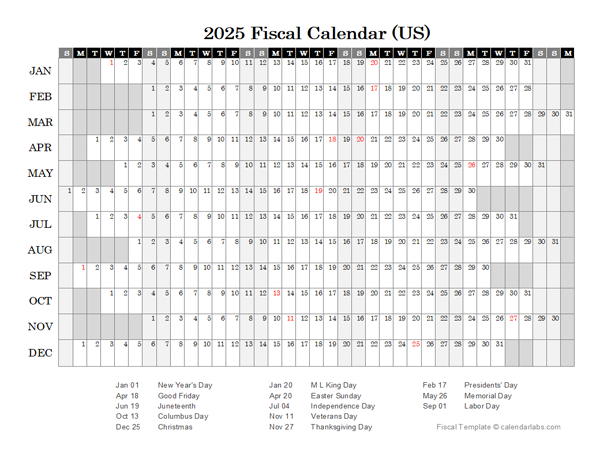

Gallery of 2025 Financial Year Calendar: 10 Key Dates